Are you looking for a way to access cash quickly and conveniently? Are you trying to find an option that can help support your short-term liquidity needs? If so, a personal line of credit could be the perfect solution.

With competitive interest rates and flexible repayment options, it's no wonder why more and more people are turning to this financing option when they need funding fast. In this blog post, we'll look at a personal line of credit, its benefits, and how to use it as part of your overall financial strategy. Read on for all the details!

Defining a Personal Line of Credit

A personal line of credit is a loan that gives you access to cash relatively quickly and easily. You can request an amount from the lender up to a pre-approved limit and receive it as soon as your application is approved. The funds are usually available for immediate use as a check or direct deposit into your account.

Unlike many other forms of financing, a personal line of credit typically comes with competitive interest rates and flexible repayment options. This allows you to adjust payments based on your financial needs without incurring excessive fees or penalties. In addition, some lenders may even offer additional benefits such as no annual maintenance fee or reward programs.

How Does a Personal Line of Credit Work

A personal line of credit works similarly to a traditional loan. When you apply, the lender will review your application and determine your available limit. This amount you can borrow at any given time is usually based on income, assets, and credit score. Once approved, you'll have access to funds whenever needed, which can be requested with a check or direct deposit into your account.

When borrowing from a personal line of credit, you only need to pay interest on the amount borrowed. If only one portion of the total limit has been used, you’ll only have to pay interest on that portion instead of the whole balance. Additionally, repayment terms are typically more flexible than other financing forms. This allows you to easily adjust payments based on your financial needs without incurring excessive fees or penalties.

Finally, personal lines of credit typically have competitive interest rates, and some lenders may even offer additional benefits such as no annual maintenance fee or reward programs. This makes it an attractive option for those who need access to quick cash but don’t want to pay exorbitant fees or bear the burden of strict repayment terms.

Most Lines of Credit Have Two Phases

1. The Draw Period

During the draw period, you can borrow funds up to your pre-approved limit and pay interest only on the amounts borrowed. This is a great way to access cash without paying for more than you use.

2. The Repayment Period

Once the draw period has ended, the repayment period begins, and you’ll need to start making payments towards principal and interest on any remaining balance. This is usually done through a fixed payment plan or gradually increasing monthly payments over time.

Types of Lines of Credit

1. Home Equity Line of Credit (HELOC)

A HELOC is a loan that uses the equity in your home as collateral for up to a pre-approved limit.

2. Business Lines of Credit

Companies who need access to short-term financing can apply for business lines of credit through lenders or banks.

3. Secured Lines of Credit

These loans are backed by an asset such as real estate, investments, or other property as collateral and often offer lower interest rates than unsecured lines of credit.

4. Unsecured Lines of Credit

Unsecured lines of credit are more flexible when it comes to repayment terms even if they do not require collateral and frequently have higher interest rates than secured ones.

5. Peer-to-Peer (P2P) Lines of Credit

These loans are funded by individual investors instead of banks or lenders and often come with lower interest rates.

6. Retail Lines of Credit

Retail lines of credit are issued to customers by stores to provide financing for purchases made at the store.

7. Medical Lines of Credit

Medical lines of credit are typically used to cover medical expenses such as doctor’s visits, hospital bills, and other healthcare costs not covered by insurance.

8. Gasoline Lines of Credit

Gasoline lines of credit provide access to funds that can be used specifically for purchasing gasoline at gas stations associated with the lender.

These are just some of the many types of personal lines of credit available, and each may come with its benefits and drawbacks. It is important to research any loan thoroughly before making a decision. Ensure you understand all the terms and conditions and the applicable fees or interest rates. Doing your due diligence can help you make smart financial decisions and find the right line of credit for your needs.

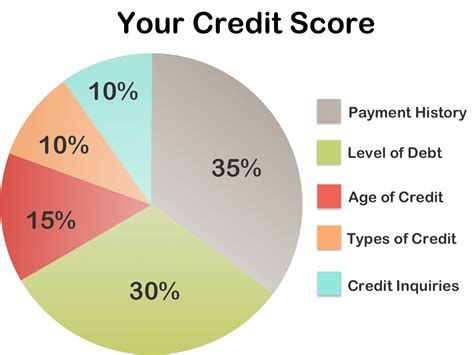

How a Line of Credit Affects Your Credit Score

A personal line of credit can positively and negatively affect your credit score. Responsibly managing the line of credit can help you build a solid credit history. On the other hand, payments must be made on time or if there is excessive debt to maintain your credit score.

When opening a line of credit, the lender will access your credit report to assess your financial risk and determine whether or not you qualify for the loan. This will result in a hard inquiry, which could lead to a small decrease in your score.

However, once approved and used responsibly over time, this type of loan can benefit your score by increasing its length and helping you develop responsible borrowing habits.

Compare Personal Lines of Credit, Credit Cards, and Personal Loans

You can use personal lines of credit, credit cards, and loans to access cash quickly and conveniently. However, there are important differences between them.

A personal line of credit is a revolving loan with a set limit that you can borrow from at any time up to the maximum amount approved by the lender. It typically has competitive interest rates and flexible repayment options.

Credit cards provide access to funds when needed but do not have a predetermined limit or repayment terms like a personal line of credit. The interest rate on your card will depend on factors such as your credit score and utilization ratio (the percentage of available balance used).

FAQs

Q: How do I apply for a Personal Line of Credit?

A: Depending on your lender, the application process may vary slightly. Generally speaking, most lenders will require a credit check to approve your loan application. Documentation such as proof of income and assets may also be required so lenders can better understand your financial situation.

Q: What are the benefits of having a Personal Line of Credit?

A: With a personal line of credit, you can access funds when needed without having to reapply for the loan each time. In addition, repayment terms are typically flexible, and competitive interest rates help keep costs down compared to other financing options. Finally, it's an excellent way to support short-term liquidity needs while building or maintaining your credit score.

Q: When should I use a Personal Line of Credit?

A: This loan product is best used as part of your overall financial strategy when quick access to cash is needed – for emergency expenses, home repairs, or medical bills. It can also help consolidate multiple debts into one easy-to-manage loan.

Conclusion

A personal line of credit can be a great way to access cash quickly and conveniently. Ensure you understand the terms and conditions, fees, and interest rates of the loan before committing to it. Properly managing your line of credit is essential for keeping costs low and building or maintaining your credit score. For more information about how a personal line of credit can help support your short-term liquidity needs, contact us today! We’re here to answer any questions you have about this financing option.